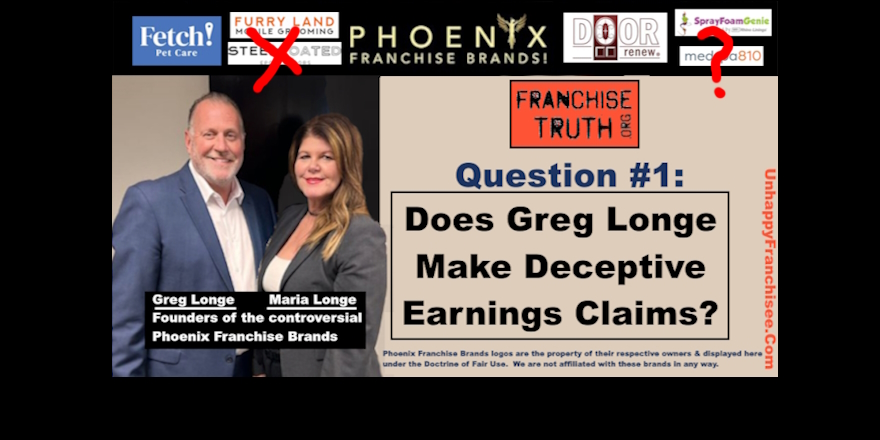

Phoenix Franchise Brands, Greg Longe Running “a Pyramid Scheme” Claims Longtime Franchisee

Tamara Bean, a successful & respected franchise owner of 17 years, claims she can no longer remain silent as franchisor Greg Longe & Phoenix Franchise Brands use her royalties and her success story to exploit individuals & families with a franchise “pyramid scheme.” by Sean Kelly

(UnhappyFranchisee.com) Tamara Bean, who is a member of the Independent Association of Fetch Pet Care Franchisees, and dozens of other Fetch! Pet Care franchise owners, accepted the FTC’s invitation to submit public comments on franchise regulations and franchisor business practices.

Tamara’s “comment,” consisted of a summary, a detailed account of alleged predatory practices by CEO Greg Longe, Phoenix Franchise Brands and others, and 6 supporting documents.

As part of our ongoing investigation, we are posting the FTC-submitted comments and hosting a discussion on Fetch! Pet Care and other Phoenix Franchise Brands here:

FETCH! Pet Care Franchise Complaints (Index)

Tamara Bean’s detailed statement is included in its entirety below.

“Phoenix Franchise Brands is running what appears to be an illegal pyramid scheme.“

To Whom It May Concern,

Thank you for the opportunity to submit my statement.

My name is Tamara, and I am a legacy franchise owner with Fetch! Pet Care, part of Phoenix Franchise Brands. I have been with Fetch! for over 17 years, and I’m writing to expose the illegal and deceptive practices being carried out by Greg and Maria Longe, owners of Phoenix Franchise Brands, and their leadership team, including Heather Bir (VP of Operations) and Carolyn Alonzo (Director of Operations).

Opening Statement

What I’m sharing today is just a tiny glimpse of the extensive fraud happening under Phoenix Franchise Brands. I am highlighting what I believe are the most egregious aspects of their scheme. Fetch!, along with three other Phoenix Brands franchises, submitted fraud complaints through the FTC website a few weeks ago. We’ve also attended two FTC consumer calls. On the advice of our attorney, Bryan Dillon, who already submitted a complaint, we are reporting Phoenix Franchise Brands to the State of Michigan Attorney General’s office for running what appears to be an illegal pyramid scheme. We desperately need the help of authorities to stop Greg and Maria Longe, along with their team, from continuing this scheme that is destroying people’s lives.Please read this recent article in the Franchise Times addressing many of the issues we are reporting.

Misleading Revenue and Profit Claims in Violation of FTC Rules

This is a public YouTube video of Greg Longo from 2020 where he claims that the top 20% of franchisees in the Fetch! Pet Care systems were generating $900,000 in revenue, which was and still is a blatantly false claim and can be confirmed every one of their FDDs.Additionally, numerous franchisees in our system were sent flyers and documents before purchasing, including one from 2021 sent directly by a Fetch! employee, claiming that the top 20% of franchisees were making $948,000 in gross revenues, which does not match what is listed in item 19 in the FDD. Another document that Fetch! provided to a broker falsely states that the net profit margin for a Fetch! franchise is 30%, a financial performance representation not listed in item 19 of the FDD. All three claims are blatantly false and violate FTC franchise rules.

Pyramid Scheme Operation

Phoenix Franchise Brands is running what appears to be an illegal pyramid scheme. They lure in new franchisees with revenue figures from legacy owners like myself, who are under favorable contracts. However, they hide that fact from prospective franchisees. The fees under the Longes contracts include a 7% royalty and a mandatory 15% call center fee, totaling 22% of weekly gross revenue. Additionally, the Longes implemented their so-called “fully passive managed- services model” last year, which requires an additional 5% of gross monthly revenue. In contrast, legacy owners like myself only pay 5%-8% of monthly gross revenue.

What’s more, new franchisees are required to pay an additional marketing fee that is now listed in the most recent Franchise Disclosure Document (FDD) at $3,800 per month, another egregious cost legacy owners are not subjected to. They frequently charge undisclosed junk fees, the mos recent being an SEO fee of $489. The FDD and franchise agreement require Fetch! to provide and pay for the website from the Brand Development Fund. Yet, they are still charging this extra fee and penalizing those franchisees who refuse to pay it by not listing their service areas on their websites. Despite being fully aware that this fee structure offers virtually no possibility of profit, the Longes continue to add more charges each year, and they have continued to increase their total buy-in price, which is now $120,000 for a business with no physical assets. Since 2020, nearly 90% of new Fetch! franchisees have failed or are failing under this fee structure.

Deceptive Practices and Violations of Franchise Law

Phoenix continues to violate the FTC Franchise Rule by hiding material facts and misleading prospective franchisees. One of the accounting firm representatives from a firm Phoenix requires all managed services owners to use recently admitted to two different franchisees that he is uncomfortable with what he is seeing within Phoenix Franchise Brands because he cannot foresee any of the owners achieving profitability under their terms. Furthermore, Phoenix has used deceptive accounting practices by directing the accounting firm to recategorize fees on franchisee P&Ls. For example, the additional undisclosed junk fee they require the franchisees to pay the accounting firm is now being listed under “office supplies,” and the call center fee (SMC) is falsely listed under “marketing expenses,” disguising the fact that it is being paid directly to Phoenix.

Manipulation of Failed Locations and Coercive Legal Releases

Phoenix quickly takes back locations when they know the franchisee is out of money instead of trying to help them succeed. This behavior further points to running a pyramid scheme. As franchises fail, the Longes take back the location for little or no compensation to the original owner. They promise to resell the location and give part of the profits to the original owner within two years. Still, in every instance I am aware of, they have either changed the location’s name or delayed reopening it until after the two-year period expires, ensuring no compensation is ever paid to the former owner. In other cases, failed locations are transferred to a select group of legacy franchisees or close allies of the Longes at minimal or no cost, perpetuating a system where those at the top benefit while unsuspecting owners are financially ruined. The Longes have also been giving failed locations to newer franchisees who are unaware of what is happening, with no paperwork or formal agreements, claiming they want to “help them out.”

When questioned, Phoenix consistently responds, “the previous owner just wasn’t the right fit.” These new owners are then forced to take on the fees and employees of that location without understanding the full implications. They also require the failed owners to sign legal releases that

remove legal recourse while reserving the right to sue the franchisee. Meanwhile, hundreds of thousands of dollars have been drained from innocent franchisees, only for the cycle to begin again with new victims.

Impact on Legacy Owners

As a legacy owner, I operate under a more favorable fee structure, but Phoenix’s actions have severely devalued my business. No buyer would want to purchase a franchise under their egregious terms, meaning Phoenix has stolen the value of a business I have invested 17 years of my life building.Furthermore, my monthly royalties are being used to perpetuate this fraudulent scheme, and I refuse to stand by while others are financially ruined using my money.

Call for Regulatory Change

The franchise industry is in desperate need of a regulation overhaul. The current system allows franchisors like Phoenix Franchise Brands to steal unsuspecting owners’ hard-earned money, retirement accounts, and life savings with little oversight or accountability. Many are now in severe debt they may never get out of, or they were forced into bankruptcy. While the recent rules prohibiting undisclosed junk fees and retaliation are a positive step, more must be done to prevent franchisors from running fraudulent schemes, misleading prospective franchisees, and exploiting innocent consumers.

Recommendations for Regulatory Action

The current level of regulation in the franchise industry is insufficient to protect franchisees from exploitation. I urge the FTC to consider the following regulatory changes to address these systemic issues:

• Extension or Elimination of the One-Year Fraud Limitation

The current one-year limitation for franchisees to sue for fraud is grossly inadequate.Many franchisees only realize they are being defrauded after years of running their business once the long-term effects of inflated fees and misrepresented financial viability take hold. The FTC must extend, or ideally eliminate, the one-year statute of limitations for franchisees to pursue fraud claims. This change is critical to ensuring justice for those who have been exploited.

• Prevent Franchisors from Using Contracts and FDD Clauses to Escape Liability

Franchisors often include clauses in their contracts and Franchise Disclosure Documents (FDDs) that release them from liability for illegal actions or deceptive public statements.

These clauses allow franchisors to lie, deceive, and avoid accountability, effectively hiding behind their contracts. The FTC must change this law to ensure franchisors cannot use these clauses to escape legal consequences, ensuring that any deceptive or illegal practices are fully punishable.

• Mandatory Full Disclosure of ALL Fees and Contract Terms

Franchisors should be required to disclose every possible fee that could be charged during the life of the franchise agreement, and any future fee increases should be strictly regulated.

• Enhanced Protection Against Retaliation

While recent rules against retaliation are a positive step, enforcement mechanisms must be strengthened. There needs to be a more robust system for franchisees to report retaliation without fear of losing their business or being silenced.

• Increased FTC Oversight of Franchise Sales and Renewals

The FTC should implement stricter oversight over how franchises are sold, including mandatory financial viability assessments for new franchisees, especially when the franchisor has a history of high franchisee failure rates. Renewal terms should also be scrutinized to ensure franchisees are not coerced into signing even more restrictive and financially devastating contracts.

• Criminal Liability for Franchisors Engaging in Fraud

Franchisors who knowingly commit fraud and exploit franchisees should be held criminally liable for their actions. The damage they cause is not just financial—it is life- altering. Franchisees invest their life savings and retirement accounts or take out huge loans for these businesses, only to have everything taken from them through deceit.

Franchisors engaging in such conduct should face severe legal consequences, including prison sentences, like a criminal who commits robbery. This would create a considerable deterrent for franchisors considering the same tactics. The FTC must ensure that franchisees who are defrauded have not only civil recourse but also that those responsible for this kind of systemic financial theft face criminal prosecution.

In conclusion, the lack of adequate regulation in the franchise industry has allowed franchisors like Phoenix Franchise Brands to operate unchecked, destroying the lives of innocent, hardworking entrepreneurs. We need stronger protections, more transparency, and meaningful enforcement of the FTC rules already in place. Phoenix Franchise Brands’ practices have stolen not only the financial futures of its franchisees but also their ability to pursue the dream of business ownership.

I urge the FTC to take decisive action to protect franchisees from further exploitation and ensure that franchisors are held accountable for their unethical and illegal practices.

Thank you for your time and consideration.

Sincerely,

Tamara Bean

Fetch! Pet Care Franchisee in Seattle

About Fetch! Pet Care & Phoenix Franchise Brands:

Livonia, MI-based Phoenix Franchise Brands was founded & is headed by Greg Longe & Maria Longe (aka Maria Shinabarger).

One or both of the Longes were previously associated with British Swim School, Martinizing International, Rooster’s Men’s Grooming Center, Zoup! (rebranded Z!Eats), & Collision on Wheels International (defunct).

Franchise Brands: Fetch! Pet Care, Spray Foam Genie, Door Renew, Furry Land mobile pet grooming, MedSpa810 & Steel Coated Floors.

Private Equity: Cybeck Capital Fund, LLC (“CCF”), a private equity fund managed by Cybeck Capital Partners, LLC of Dayton, Ohio, acquired a portion of the issued and outstanding common stock of Fetch! Pet Care, Inc. and retains a minority ownership interest in Fetch! Pet Care, Inc.

Litigation: Phoenix Franchise Brands is being sued by call center provider EagleOne Insights, LLC.

Franchise Registrations appear to be expired in multiple states (CA, MN, & IN). Most recent FDD expired September, 2024

Please share your story, your experience or opinions of the Fetch! Pet Care franchise and Phoenix Franchise Brands Franchises

Invitation: Please Share Your Opinion of Experience (Anonymity Assured)

Are you familiar with Greg Longe, Maria Longe, Phoenix Franchise Brands, or Cybeck Capital Fund?

Please leave a comment below or email us, in confidence, at UnhappyFranchisee[at]Gmail[dot]com.

Franchisors: The franchisor, its employees and agents are invited to submit correction, clarifications, rebuttals or other opinions for immediate consideration.

UnhappyFranchisee.com is not associated with this or other franchise company or seller.

Tags: Fetch! Pet Care franchise complaints, Fetch! Pet Care franchise, Fetch franchise, Phoenix Franchise Brands, franchise complaints, Greg Longe, Maria Longe, Maria Shinabarger, pet franchises, Rhino7, Cybeck Capital Fund, LLC (“CCF”), Cybeck Capital Partners, LLC, dog franchise, Furry Land franchise, Spray Foam Genie franchise, Door Renew franchise, MedSpa810 franchise, Steel Coated Floors, Federal Trade Commission, FTC

My name is Carolyn Alonzo, first and foremost, I am a small business owner, and I have owned my Fetch! Pet Care business since November of 2007.

Please let it be known that I am a very happy and satisfied FPC owner. My experience with Fetch! Pet Care for every single one of my 17 years has been personally and professionally fulfilling. I have worked hard, I have followed the suggested best practices and while it hasn’t always been easy, it’s still one of the best decisions I’ve ever made. I have met some wonderful people, had exciting experiences and have been able to employ some of the best pet lovers in my city.

Small business ownership isn’t for everyone. Some succeed and some do not. It is not meant to be easy. It is hard work and there are no guarantees in life, especially when it comes to business.

It is high risk, high reward.

There are many other FPC owners that feel the same way I do; I know this firsthand.

Sincerely,

Carolyn Alonzo

I have been a Fetch! Pet Care owner for almost 17 years. My franchise has grown and persevered through multiple franchisors during that period.

I am considered a legacy owner. I have a contract with reasonable royalty and marketing fees and no required vendors to use.

It is very unsettling to me that Phoenix Franchise Brands has not improved the experience of the franchisee but made it worse.

While business ownership isn’t for everyone, having a platform for “passive income” and a fully managed business fail is on the franchisor not the franchisee. There are many who have “failed” with this business where they had little personal control over performance.

I stand by those who fell victim to this contract. Those who have been financially ruined. Those whose families could not endure stress of the loss.

I stand seeking compensation and repair of the brand image so when I am ready to sell I can sell for what my franchise is worth and not less because a newer contract is constructed in a manner that makes success highly unlikely.

My agenda and allegiance here is clear. I am a Fetch! Pet Care business owner who has grown an established business YTD 40% over last year.

I am not a PFB employee with divided loyalties or agendas.

Carolyn

I am glad that you have been happy for the last 17 years. However, you left out a few extremely important facts that have probably attributed to your happiness.

You failed to mention that you are on Maria and Greg Longe’s payroll as a Region Manager and Director of Operations.

In addition, you bought your business 17 years ago and have a completely different royalty fee structure. Please tell the community the difference between your fee structure from when you signed 17 years ago to the debilitating fee structure that franchisees are required to pay since Maria and Greg took over the business.

Ms. Alonzo:

Thank you very much for sharing your opinions and your experience as a longtime Fetch! Pet Care franchisee.

Would you mind clarifying a few things?

*****

Are you a “Legacy” owner?

If so, have you operated under significantly more favorable terms (& lower fees) than a prospective franchisee would be granted if they signed up today?

If so, isn’t that that something that should be disclosed in your franchise testimonials?

*****

Are you a corporate employee of the franchisor?

Your LinkedIn profile includes the titles “Regional Leader and Recruiting Manager for Fetch! Pet Care.”

An FTC complaint submitted by a fellow Fetch! franchisee named you twice as the “manager” in charge of billing them a $2900 per month marketing fee.

If you ARE a corporate employee, shouldn’t that be disclosed as part of any testimonial you give?

*****

Do you believe a faulty or ineffective franchisee recruitment & qualification process is contributing to these massive problems?

You imply that Phoenix Franchise Brands is granting franchises to people who are lazy and not suited for business ownership.

Could the Longes be victims of commission-hungry brokers recommending unqualified franchise prospects?

*****

You emphasize that the Fetch! Pet Care franchise requires a tremendous amount of hard work and should be regarded as a “high risk” investment.

Should your employer stop representing that “Fetch! Pet Care is a semi absentee franchise and allows passive ownership,”?

Should they stop claiming “Corporate helps Franchisee run the business” via its Corporate Management model?

*****

Two last questions (sorry!)

Have you calculated what you’d be paying in fees and expenses if you were operating under the current agreement? Would you be just as happy?

Finally, In your opinion, should Phoenix Franchise Brands stop selling franchises until they can determine and fix the problems that have led to massive complaints and failures… even if it is a franchisee selection problem?

I hope that you’ll address these issues and that we can continue this constructive dialogue.

I’m sure you’d have appreciated someone asking hard questions on your behalf when facing your franchise decision 17 years ago!

Chicagoan & Fellow Cubs Fan,

Sean Kelly

As legacy owners with a contract from the initial start-up person for Fetch! Pet Care, we have a reasonable contract and make a reasonable profit. HOWEVER, at age 65 when we would like to sell our franchise, we’ve had 2 potential owners recind their interest. Both read the current contract and logically deduced that there’s $0 profit to be made, and most likely they would lose money.

We agree with the information presented about Phoenix Franchise Group. Unlike Carolyn Alonzo, who besides having a “small business” is also working directly for Greg and Maria as a regional manager, we are very unhappy with this situation. After 16+ years in business, we should be able to see our very nice business sell for a good profit. That is currently not possible.

Caroline,

You and I haven’t worked directly together. I’ve heard enough from those who have you as their Regional Manager to know you’re very much an enforcer in Phoenix Franchise Brands’ pyramid scheme.

What do you think will be different for you when your current contract is up in three years? If you choose to sell, do you truly believe Greg & Maria Longe will care about the worth of your business, and let potential buyers have the same legacy contract you’re under? Do you really believe they will leave thousands of dollars in predatory fees on the table—for you?

Let’s take a step back into reality and look at the number of lawsuits Phoenix Franchise Brands is facing, including the recent group arbitration. What do you think will be left for the handful of franchisees, like yourself, who are helping the franchisor defraud the vast majority of franchisees with claims like the one you made here?

I feel sorry for you. You, your husband, Heather Bir—you all chose to help Greg & Maria build their house of cards, and it’s collapsing.

Carolyn, doesn’t your partner work for PFB too?

Carolyn, doesn’t your husband work for PFB too?

Along with everything already stated above, I’d like to add that I have personally called people in all 4 franchises. Likely around 200 or more franchisees. I was just casually asking them how things were going for them, explaining that I also was an owner and have been struggling still to make a profit. Allowing them the space to tell me how things were going from their perspective. Most had the same story of losing massive amounts of money and not getting any assistance from corporate. Many had closed, just deciding to realize their loss. Some were unsure how things were going, because they just got started. Some of the stories were so terrible; people losing their homes, marriages ruined, people wondering how they could feed their children because they had nothing left. It was emotionally draining and sometimes all I could do to not cry myself while listening. Not one person told me they were happy. Not one. How people in corporate can hear these stories and keep moving forward business as usual, is beyond me.

To say all of these people, who gave their life savings to this, were just “not working hard enough”, that maybe “business ownership isn’t for them”, is truly terrible. Especially when it’s printed all over every Phoenix franchise sales flyer that these are “managed service contracts” and “passive income”; in order to justify charging such high fees.

I hope people can see through responses like the one from Carolyn above. There is a systemic issue that needs to be addressed in these franchise models.

First, it speaks volumes that out of approximately 90 active Fetch! franchise owners, Carolyn is the only one who has come to the defense of the company publically. This is not a coincidence, as she has been directly working for Greg and Maria since 2020. As mentioned above, she started as a Regional Manager and was recently promoted to Director of Operations.

As a fellow legacy owner of 17 years—I opened my Fetch! location in April 2007—and as the individual who submitted the FTC complaint mentioned in the article above, I would like to respectfully address two important points in response to Carolyn’s comments.

First, as a legacy owner, my royalty rate is only 5% of my monthly gross revenue, likely similar to Carolyn’s. This rate allows me to cover my expenses, save for retirement, travel, and maintain a comfortable lifestyle. If I had to renew my franchise agreement under the terms set by Greg and Maria, I would be forced to find a full-time job. Otherwise, I would have to sell my home and live out of my car, and this is not an exaggeration. To provide further perspective on how egregious their fees are, my location is among the top four largest in the company, generating over a million dollars in gross revenue annually.

Second, as a Regional Manager, Carolyn has worked closely with most of these franchise owners. To dismiss the high failure rate under Greg and Maria’s contract as “small business ownership isn’t for everyone, some succeed some do not” and pretend to be unaware that the vast majority have either lost their homes, drained their retirement savings, suffered from failed marriages, gone bankrupt, or worse, can only be intentional. The current failure rate for Fetch! franchisees is unprecedented compared to before Greg and Maria acquired the company. Since both of us have been owners for over 17 years, she is as aware of this fact as I am. When you take a viable business model and implement a fee structure with the primary purpose of extracting as much money as possible from the owners, failure becomes the only option. Ignoring these harsh realities in order to defend the indefensible is, quite frankly, incomprehensible.

I wanted to make sure to point out that the unprecedented failure rate mentioned in Tamara’s post above, that I personally uncovered while calling as many people as I could in the franchise system, does not show up in any of the FDDs somehow.

In 2021, our daughter invested in a Fetch! Pet Care franchise. She was drawn in by promises of passive income, substantial corporate support, and the potential to generate up to $800K in annual revenue. Sadly, these promises have proven false. Our daughter invested nearly $200k and my husband and I invested $20k out of our retirement savings, into this while following the advice of Fetch! Corporate to “increase marketing funds” and things would turn around; only to see her have to sell her home when things did NOT turn around.

The contract terms shifted dramatically when Phoenix Brands, under Greg and Maria Longe, acquired Fetch! in 2020. Legacy franchise owners, such as Carolyn, who benefit from a Director of Operations role and a Regional Manager position, still pay only about 5- 7% in fees monthly. However, franchisees under the new managed models introduced by Phoenix Brands in 2020 face burdensome weekly minimum fees. The lowest a franchisee will pay weekly now is 22%-30%. Due to the “minimum”, if someone has a slow week these fees can surpass 50% of total revenue.

The Phoenix Brands’ “Fully Managed Contract” was marketed as a “hands-off” investment, where the franchisor would market, bring in customers, hire sitters, and handle operations, leaving franchisees to simply collect income. (Even though Carolyn alludes to the lack of business being the fault of the franchisee, the point of this contract is you pay a high fee, and corporate does nearly all the work) Yet, for many owners across Phoenix Brands, this vision has not materialized. Investors have poured thousands of dollars into purchasing vehicles, retrofitting them for dog grooming, buying supplies, and more, only to find themselves without any revenue or customers six months later. Some closing their doors and going broke before even getting a single paying client.

A further concern is the added lure of a U.S. Visa attracting foreign investors. They are selling their homes/cars, etc., in their home country and relocating their families to the U.S. with dreams of stability and opportunity, only to face the same lack of support and operational setbacks. Worse, these individuals are unable to work outside of Fetch! because of the terms of the visa, leaving them without an alternate income source to support their families.

The stories of financial loss and despair are overwhelming. While a very select few, like Carolyn, may find some success (which to some is just “breaking even”), the majority of new franchisees signed since 2020—including our daughter—are struggling just to stay afloat and Greg and Maria do nothing to alter their terms to make it possible for everyone to thrive in this wonderful Pet Business. Not just Greg and Maria.

As a newer Fetch! owner, we were so excited to start this business! Not only have we invested our heart and soul but thousands and thousands of dollars in the hopes of growing a successful business. We now know that our dream, our livelihood will never be what we hoped as Fetch! franchises have been set up to fail. Greg and Maria have been lining their pockets not only with the money we invested but also with what we should be making. Devastated, angry and heartbroken are the few words that come to mind to describe how we feel. It’s sad and pathetic that they are blaming the franchisees, making us out to be the bad guy instead of taking responsibility for their actions. Shame on them.

I’m disappointed reading your comment, Carolyn. Especially since we’ve gotten to know each other a little better doing events together with our territories being next to one another. The business model you’ve been under since you began in 2007 has been the legacy model before Greg and Maria’s time, which allows you the room to profit and actually make a living. Your model doesn’t require you to use a call center for an exorbitant amount out of your revenue on a weekly basis. An incompetent call center at that…which we both agreed to be the case.

You work for the franchisor and your loyalties may be to whoever signs your paycheck but the Carolyn I’ve gotten to know would never stand for the way they’ve treated people and continue to do so to this day.

Last thing I’d like to clarify is the comment that not everyone is meant to be a business owner. While that might be true, it’s not applicable in our case. We have some of the top performing franchisees leading the charge on exposing the franchisor’s deceptive practices.

I am a former owner Fetch Pet Care. Sadly – I was forced to give my location back to Maria and Greg or face financial ruin. I worked extremely hard at my business and it was growing at a rate that was impressive by most people’s assessment. Unfortunately, even with that growth, my business remained in the red due to the crushing WEEKLY minimum that we under.

I walked away from my location feeling like a failure. It was only after speaking to many former and current owners (which was discouraged at every turn by the Fetch Leadership while I was an owner – now I understand why) I have come to realize that I was not a failure – the system was the failure. The stories that I have heard are nothing short of heartbreaking. Greg and Maria knowingly led people into financial ruin with empty promises time and time again. They have to be stopped from doing this to anyone else.

I am so disappointed in reading Carolyn’s comments. I would really like to see her responses to the questions that were posed by Sean – but I know that is not forth coming. Karma is coming to bite them.

As a Spray Foam Genie owner since 2023, I can echo the experiences of every franchisee here, easily corroborating Tamara Bean’s experience & accusations.

With the noted exception that our losses are double to quadruple what most Fetch owners have lost.

Of the just under 60 franchisees who signed on for their overpriced & grossly misrepresented area developer opportunities between 2022 & 2023, 50% are already either closed or, transferred ownership of their failed locations under duress to either a preferred member of the Franchise Advisory Council or an unsuspecting new franchisee.

Additionally, while we were told that in addition to our area dev franchise fee (which ranged from $65,000 – $300,000+ depending on the number of rigs they calculated would thrive in your market) an additional $215,000 would be sufficient capital to fund the business to profitability. I have yet to meet or talk to any Spray Foam Genie owner from this signing period who has spent less than double this liquid capital estimate. Many are 2.5x to 3x this amount and still not profitable with a single rig.

Which, by the way, was all personal cash since Rhino7 and Phoenix refused to do deals with people who wanted to leverage SBA loans (while I speculate, my guess is they knew running a pyramid scheme with federally guaranteed money is likely a fast track to federal prison). This total personal expense doesn’t include our financing exposure on a grossly overpriced double rig we were all told was necessary from the start because their “done for you” commercial bidding team (plus 5% more off the top) was going to fill that pipeline fast (despite only the cheaper single rig being disclosed in the FDD), a Hemi diesel pickup & forklift & a $65,000+ equipment package we could all have acquired on our own for probably less than $40,000.

Add in the exposure most of us have on long term commercial leases of property needed to store our equipment & chemicals.

In total, most SFG franchisees are underwater ~$1M and still not profitable after 12 – 18 months of operations with just a single rig deployed.

Then add in that 90% of these buyers (this was confirmed by Kevin Longe in a personal conversation some time ago) signed on for the passive investor program (another 5% off the top, thank you very much; 5% more for SFG, none for thee, so it seems) where everything was supposed to be “done for you”, and you have the perfect recipe for the biggest shit show I’ve ever seen in franchising.

I used to think that this company couldn’t afford to fuck things up given that Greg’s wife, kids, their spouses, extended family, close friends and spouses of close friends worked for the corporate team. Now I am left with the impression this was all to line the pockets of their family & buddies with our hard earned cash.

No one on their corporate team can look in the mirror today and not be aware of the lifetime damage they are causing to hundreds of families across America, and now across the world as even E-2 visa holders are being defrauded to move here. The fact that any of these people continue to show up and help the Longe’s & Ryan’s perpetuate this fraud means they either don’t care, are too afraid to speak up, or are simply in on the grift (possibly all three).

The stories I keep hearing from owners who leveraged it all to try just “a couple more months” to get to profitability are heartbreaking.

It is my sincere hope that the FTC, State’s Attorney Generals and/or private owner lawsuits will finally hold these people accountable.

And I hope that having Phoenix Franchise Brands on a resume is the permanent scarlet letter it deserves to be for any of their senior and mid-level managers.

I am a Fetch Pet Care owner based in Southern California and purchased my location four years ago. Like many others who have commented here, I was drawn to this opportunity with the understanding that I was investing in a franchise community that felt like family. Unfortunately, my experience has been quite the opposite.

Since signing our agreement, I have only spoken with Greg a handful of times and have actively avoided interactions with Maria. As a minority business owner, I feel I have been treated as just that—an outsider rather than a valued member of the community. Despite being one of the few locations under Maria and Greg that has consistently operated in the black since year two, this success has come at a significant cost. I had to step outside the traditional services offered by Fetch and get creative by providing services like dog training, pack walks, and leash training just to survive.

While I am grateful for my success and the incredible team I’ve retained, the reality is that I barely receive a paycheck. The more successful I become, the more I pay to the franchise, which positions me further away from achieving my goal of passive income. This situation is heartbreaking. As a mother of three young children, I often have to take on consulting jobs to contribute to my household income.

My frustration with the Fetch Franchisors stems from the lack of value they provide. I have a mere 0.5% conversion rate on leads from the Fetch Call Center. Yes, you read that correctly—0.5%. The call center, which was touted as a primary benefit of our franchise investment, has instead led to more losses than gains. In nearly four years, I have gone through six Regional Managers, three website changes, three shifts in marketing partners, and four Call Center managers. This instability is clear evidence of how the franchisors fail to value their employees and franchisees.

Despite paying 28% in royalties weekly, I have received little to no support or value in return.

In response to Carolyn’s condescending remarks about business ownership being hard work and not for everyone, I must say how offensive that statement is to franchisees like myself. We work incredibly hard just to stay afloat while you and your so-called leaders reap the benefits at our expense.

I was sold on the managed plan and that corporate would handle most of the day to day. I was told they would hire a lead sitter to run things in my territory. I only just got a candidate a year later.

I was hoping to build this so I could retire and run things full time. Only to find myself in debt in excess of $150,000.

The weekly fees are just impossible to meet, not to mention their calculations are a bit sketchy too. Corporate answers that we should give more to advertising. The only advertising I have seen is on Instagram, well that helps tremendously no one ever said. So hmmm where does that money go?

We purchased a Spray Foam Genie (SFG) franchise is 2023 under the direction of Phoenix Franchise Brands and in the care of unqualified Kevin Longe (Greg and Maria Longes son). Kevin is the denounced cult leader (CEO) of SFG. We purchased the franchise with the promise of “managed services” that was truly too good to be true. Upon purchased they promised we would be up and running within 90 days and all we had to do was create the entity and the rest was to be taken care. But don’t fret it was took 2 hours per month of the owners time and they would handle the rest. Unfortunately us and many other savvy business owners fell victims to their scam. Within one month we knew we had been duped.

We were pressured to press along as we were already knee deep over 500k. We had no option but to “hope” things would get better. (Once again our bad)

The FDD and the line 19 is nothing but lies and deceit. Written proof of financial lies and insurance fraud have been proven. The nepotism runs deep with many family roles managing funds of franchisees that have no qualifications to be in their positions. Hundreds of thousands of wasted on marketing, call centers (one which is in a current lawsuit for hundreds of thousands), erroneous charges, travel funds and the list goes on.

We’re personally out over 800k from these fraudsters. Greg Longe had a history of crooked behavior and the Longes and Ryan’s need to be held accountable for their actions (I’m afraid they are also victims of the Longes) It’s frightening. I’m not sure how these folks sleep at night but doom is imminent. I’d encourage whomever reads this to look into this and run deep. There’s so much to this nightmare that can’t be fully explained here. I’d encourage you to call a handful of their franchisees and the story will tell itself. Their brands are (Fetch Pet Care, Furry Land, Spray Foam Genie, Door Renew). These families need to be held accountable for destroying lives. Absolutely heartbreaking for what they are “achieving”.